Know the Drill - November 2020

Know The Drill - November 2020

Welcome to the November issue of Aon Construction’s Know the Drill. In this issue we:

-

Discuss material disclosure of business activities and our recommendations to avoid nasty surprises at claim time; and

-

Introduce Aon Risk Management Services, specialising in construction project risk.

Material Disclosure

In the current changing (and often challenging) business environment, we have seen many contractors expanding their operations into areas they traditionally have not undertaken. This could include:

-

Civil contractors moving into vertical construction;

-

Construction companies providing maintenance/building management activities;

-

Commercial buildings undertaking residential construction (or vice versa);

-

Interior contractors undertaking structural work

-

Contractors commencing external hire of ‘standby’ Construction Plant & Equipment assets;

-

Project Managers becoming Head Contractors.

If you are considering growing your business into new revenue streams it’s important to remember that the principle of ‘utmost good faith' is relevant to insurance contracts, legally obliging all parties (both the insured and the insurer) to act honestly and not mislead or withhold critical information from one another. This enables the insurer to fairly assess and underwrite the activities, risks and exposures of the insured.

Violations of the doctrine of good faith can result in claims being declined, contracts being voided and sometimes even legal action.

When providing material disclosure, a key consideration needs to be the accuracy of the business activities that you, as the insured party, undertakes. You need to disclose this to your insurer as this forms part of their underwriting and risk assessment (whether they take on a risk, at what price/premium, and on what basis of coverage/policy wording).

It is important to keep your broker and insurer informed of any material changes to your business activities when they occur, rather than waiting for the renewal of your insurance policies. As the insured, you should always regularly review the business activities/professional business services descriptions contained within your policy wordings to ensure these reflect the work you are actually doing.

Aon Risk Management Services | Project Risk Management

Aon is the only insurance broker in New Zealand that offers integrated Risk Management Services, working collectively alongside our specialist Construction practice to help business owners, contractors and insurers manage construction project risks.

As a division of Aon, Risk Management Services is committed to helping business owners and contractors create a positive social impact and achieve their strategic goals and economic growth.

With new construction developments transforming New Zealand, this unprecedented growth cycle creates a significant increase in the construction industry’s risk exposure.

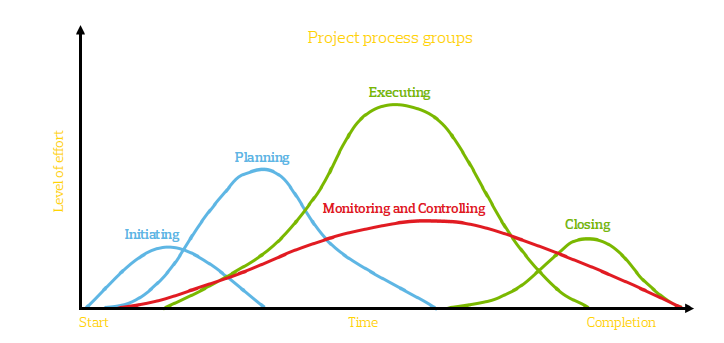

Project Risk Management is designed to provide the crucial insights and practical solutions needed through each project phase to prevent unnecessary exposure to risk. It is essential to the success of a construction project, but it can also be a daunting task.

Aon Risk Management helps our clients to deliver projects with reduced claims, reduced delays, reduced cost overrun exposure and an improved risk profile.

Aon takes an end-to-end approach to construction Project Risk Management (through the below services) and manages constructions risks by:

-

Evaluating the effect of systemic risks on project schedule and budget;

-

Recommending risk management solutions to protect the project schedule and budget;

-

Lead workshops to:

-

Incorporate earlier learnings;

-

Develop a risk aware culture;

-

Collaborate on risk management between the principal and contractor;

-

-

Perform qualitative and quantitative risk analysis and performance assessments; and

-

Provide independent project risk updates to stakeholders.

Uniquely, Aon’s integrated approach to risk translates benefits through to insurance collaboration with tour specialist Construction practice: - Perform an Insurable Risk Profile to validate and recommend the best total insurance options;

- Independently support and suggest the best insurance solutions for the hand-over stage;

- Provide property underwriting surveys during and after the project handover;

- Provide valuation services for projects to ensure appropriate sums insured;

Find more information on Aon Project Risk Management here.